The global Automotive Fleet Leasing market, valued at $26.5 billion in 2023, is expected to grow to $35.2 billion by 2030, achieving a compound annual growth rate (CAGR) of 4.1% over the period. This detailed report provides insights into market trends, drivers, and forecasts to support informed business decisions.

Key drivers of market growth include the increasing need for efficient fleet management solutions amid rising operational costs and stringent regulations. Technological advancements in vehicle telematics and fleet management software have made leasing more attractive by enhancing visibility and control over fleet operations. Leasing offers economic benefits, such as reduced capital expenditure and predictable budgeting, making it appealing to businesses, especially during economic uncertainties.

The shift towards sustainability and green initiatives has increased demand for newer, more efficient vehicles, which leasing companies are well-positioned to provide. The growth of e-commerce and logistics sectors, requiring scalable transportation solutions, further supports market expansion. These trends, combined with a preference for flexible business solutions, drive robust growth in automotive fleet leasing.

Key Insights:

- Market Growth: The Open-Ended Leasing segment is projected to reach $21.6 billion by 2030, growing at a CAGR of 4.4%. The Close-Ended Leasing segment is expected to grow at a 3.7% CAGR during the same period.

- Regional Analysis: The U.S. market, valued at $7.2 billion in 2023, is forecasted to grow, while China is expected to reach $7.5 billion by 2030, with a CAGR of 7.8%. Other key regions include Japan, Canada, Germany, and the Asia-Pacific.

Report Features:

- Comprehensive Data: Annual sales and market forecasts in USD from 2023 to 2030.

- Regional Insights: Detailed analysis of markets in the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Major players such as Autoflex Leasing, Ayvens Group, Caldwell Leasing, and others.

- Complimentary Updates: Free report updates for one year to stay informed of the latest developments.

Key Questions Answered:

- How is the global automotive fleet leasing market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments are expected to grow the most?

- How will market shares for various regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Key Attributes:

- Report Length: 250 pages

- Forecast Period: 2023 – 2030

- 2023 Market Value: $26.5 billion

- 2030 Market Value: $35.2 billion

- CAGR: 4.1%

- Coverage: Global

Market Trends & Drivers:

- Growing popularity of flexible leasing solutions

- Increased demand for cost-effective fleet management

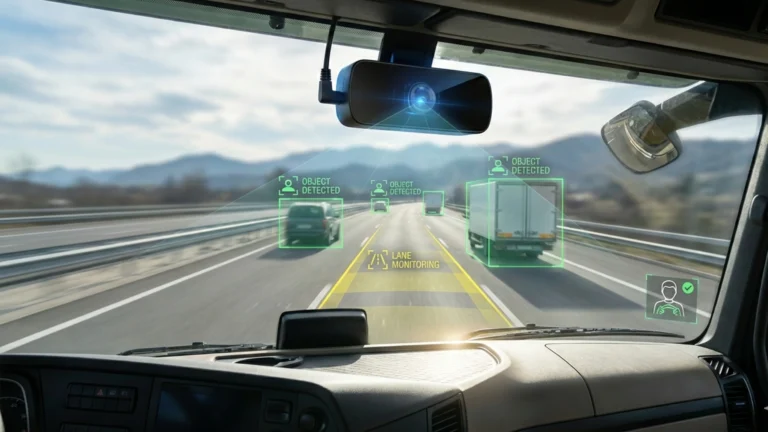

- Advances in telematics and fleet management technologies

- Expansion driven by e-commerce and delivery services

- Adoption of electric vehicles and green fleets

- Technological innovations in vehicle tracking

- Collaboration between leasing companies and OEMs

- Rise in ride-sharing and mobility services

- Subscription-based models and data analytics in fleet management

- Growth in commercial vehicle leasing in emerging markets

Featured Players (Total 86):

- Autoflex Leasing

- Ayvens Group

- Caldwell Leasing

- D&M Leasing

- Deutsche Leasing AG

- Element Fleet Management Corp.

- EMKAY, Inc.

- Glesby Marks Leasing

- Holman

- JATO Dynamics Ltd

- Merchants Fleet Management

- Momentum Fleet Management Group, Inc.

- Pro Leasing Services, LLC

- Quest Automotive Leasing Services Ltd.

- Tuv Sud AG

- Union Leasing

- Velcor Leasing Corporation

- Wheels, LLC