2025 Automotive MCU Industry Report: China’s Rapid Ascent in Intelligent Vehicle Control

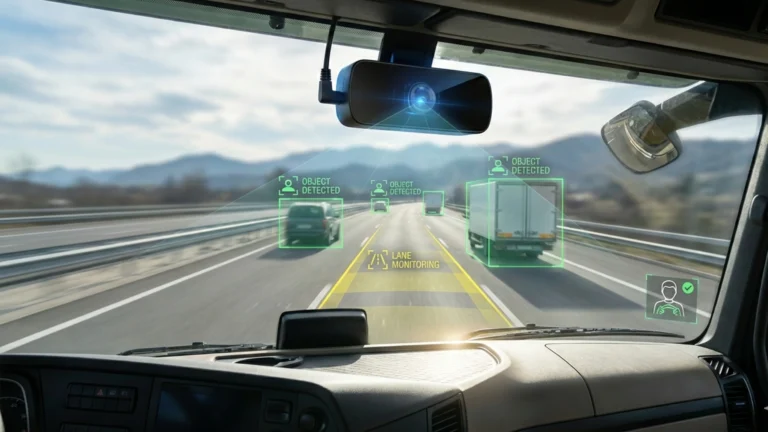

The global automotive industry is undergoing a major technological transformation, with vehicles becoming increasingly defined by software, intelligence, and electrification. At the core of this evolution lies the automotive microcontroller unit (MCU)—a vital component in ensuring safe, efficient, and intelligent vehicle operation. The newly released “Automotive Microcontroller Unit (MCU) Industry Report, 2025” from ResearchAndMarkets.com provides in-depth analysis of emerging trends, domestic innovations, and the shifting dynamics of this critical semiconductor segment.

A Maturing Supply Chain for Automotive MCUs in China

China’s drive to establish a self-sufficient and controllable supply chain for automotive MCUs is accelerating. As demand surges for higher-performance and more reliable MCUs to power increasingly complex vehicle control systems, Chinese vendors are making strategic investments to close the technological gap with foreign competitors. By 2027, it is projected that 16.3% of China’s passenger vehicles will adopt a “quasi-central + zonal” electrical/electronic architecture (EEA), while 14.3% will move toward a fully “central + zonal” architecture. These developments are expected to significantly boost the market demand for mid- and high-end automotive MCUs.

Technology Advancements: From 40nm to 16nm Nodes

The current landscape of automotive MCUs is dominated by mature 40nm process nodes. However, as the EEA evolves, next-generation automotive MCU products are beginning to leverage more advanced manufacturing nodes such as 28nm, 22nm, and even 16/18nm, enabling superior performance, efficiency, and reliability.

These advanced MCUs are increasingly deployed in mission-critical systems such as zone control units (ZCUs), central domain control units (XCUs), powertrain and chassis domain controllers, and central computing units (CCUs). Common application areas include electric power steering, anti-lock braking, electronic stability control, airbag deployment, inverters for new energy vehicles (NEVs), and battery management systems.

Infineon and Renesas Lead at the High-End—But China is Catching Up

Infineon’s TC4x and Renesas’ RH850 series currently dominate the high-end automotive MCU space, with both series supporting advanced node technologies ranging from 16nm to 28nm. These MCUs are widely used in autonomous driving and powertrain applications, setting a high benchmark for reliability and performance.

Nonetheless, a number of Chinese semiconductor companies are beginning to emerge as viable alternatives. Companies like SemiDrive are delivering breakthrough products in the mid-to-high-end MCU space, with strong potential to compete globally.

SemiDrive’s E3 Series: Targeting Intelligent Control

In 2024, SemiDrive expanded its E3 series of MCUs to address key application scenarios across zonal EEA architectures. These include body control, power domain integration, and super domain control platforms. The E3119, E3620B, E3650, and E3800 chips comprise a portfolio designed for scalability, performance, and power efficiency.

The standout performer, the E3650, exemplifies the new generation of intelligent automotive control. Designed for deployment in ZCUs and DCUs, the E3650 boasts:

- 40% increase in computing performance through an ARM Cortex-R52+ lockstep multi-core cluster, with clock speeds up to 600 MHz.

- 30% greater storage capacity and the highest peripheral and GPIO count in its class.

- 50% better low-power performance, thanks to an onboard SSDPE communication engine that alleviates CPU load and reduces latency.

- Robust cybersecurity, including SemiDrive’s Xuanwu Ultra-Secure HSM, compliance with ISO 21434 and Evita Full, and custom encryption/decryption support.

The E3650 is also optimized for virtualization with Hypervisor support, enabling OEMs to isolate software functions and reduce system BOM costs by up to 60%, depending on design architecture. Sampling has begun, and several major Chinese OEMs have already selected it for future vehicle platforms.

RISC-V Architecture: A New Frontier for Automotive MCUs

While ARM remains the dominant architecture in areas such as infotainment and ADAS, RISC-V is rapidly gaining ground—especially in the body, powertrain, and chassis domains traditionally led by PowerPC and Infineon’s TriCore architectures.

RISC-V offers a number of compelling advantages for automotive applications, including low development thresholds, zero licensing fees, and the flexibility to develop proprietary custom chips. It has sparked a wave of innovation among Chinese companies aiming to build independent, secure, and high-performance MCU solutions.

Chinese Innovators Embrace RISC-V

Companies such as HPMicro, Nanjing Cercis Semiconductor, and Wuhan Binary Semiconductor are leading the charge. HPMicro, for example, has partnered with Andes Technology and Jingwei HiRain to launch a full RISC-V ecosystem. Its HPM6200 product line has earned ISO 26262 ASIL D certification and AEC-Q100 Grade 1 approval, with operating ranges suitable for automotive-grade applications.

Cercis Semiconductor’s M100 chip delivers a high CoreMark score of 2.42/MHz, ASIL-B compliance, hardware cryptography (SM2/3/4), and ISO 21434 cybersecurity conformity. Great Wall Motor has committed to integrating Cercis chips into multiple models, with expected deployments exceeding 2.5 million units over five years.

Market Trends and Forecasts

The report offers detailed projections and data-driven insights into the automotive MCU market, including:

- Global market size from 2024 to 2028E

- China’s domestic MCU production trends and usage patterns

- OEM demand breakdown by domain and system application

- Price trends and development cost structures

- Competitive benchmarking between Chinese and foreign MCU offerings

OEM Adoption: A Closer Look

Major OEMs are already adapting to the EEA-driven shift in vehicle architecture by evaluating and integrating high-performance MCUs across critical systems. The report includes case studies and statistics on MCU model adoption by leading automakers such as Tesla, XPeng, BMW, Great Wall Motor, and Volkswagen.

OEMs are prioritizing key factors such as virtualization support, power efficiency, cybersecurity standards, and long-term supply security when selecting MCU partners. This shift presents opportunities for emerging Chinese vendors to challenge the status quo.

Key Takeaways

- China’s automotive MCU sector is transitioning from reliance on foreign supply chains to developing competitive, locally-sourced alternatives for intelligent vehicle control.

- SemiDrive and other domestic vendors are already delivering products that rival global incumbents in performance, reliability, and integration.

- The adoption of RISC-V architecture is enabling more flexibility and innovation, potentially disrupting the market landscape in domains traditionally dominated by ARM, PowerPC, and TriCore.

- OEMs are increasingly demanding integrated, secure, and virtualization-ready MCUs that align with evolving EEA trends.

As the automotive MCU market enters a new phase driven by intelligent mobility, Chinese companies are seizing the opportunity to establish themselves as global leaders in this pivotal space.