4D Imaging Radar in Autonomous Vehicles: Market Outlook, Competition, and Technology Insights for 2025

The global automotive industry is undergoing a rapid transformation, with radar technology emerging as one of the most critical enablers of autonomous driving. A newly released report, “4D Imaging Radar in Autonomous Vehicles – Industry, Market, and Competition Analysis 2025,” from ResearchAndMarkets.com, highlights how 4D radar is reshaping Advanced Driver Assistance Systems (ADAS) and paving the way toward fully autonomous vehicles (AVs).

In 2024, the global 4D imaging radar market for automotive applications was valued at nearly USD 2 billion. With demand accelerating across passenger cars, trucks, and robotaxis, the market is forecast to reach USD 10 billion by 2030, reflecting a remarkable 38% CAGR. This explosive growth is being driven by consumer demand for safety, stringent regulatory mandates, and the urgent push toward SAE Level 4 and Level 5 autonomy.

This article explores the report’s key findings, covering radar adoption in ADAS and AVs, the rapid shift from 3D to 4D radar, current radar technologies and frequency bands, competitive strategies, regional market dynamics, and the vast potential of robotaxis and shuttles.

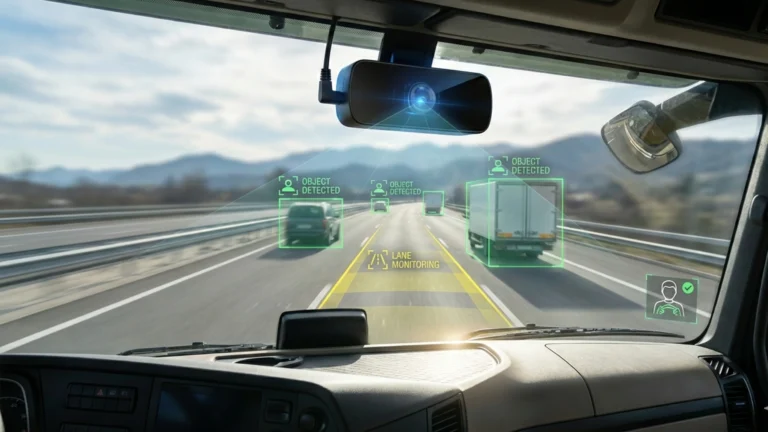

Radar Sensors: The Backbone of ADAS and AVs

Radar sensors are already deeply embedded in modern vehicles, powering ADAS features such as:

- Adaptive Cruise Control (ACC)

- Automatic Emergency Braking (AEB)

- Blind Spot Detection (BSD)

- Lane Change Assist (LCA)

- Child Presence Detection (CPD)

Unlike cameras and LiDAR, radar provides reliable detection in adverse weather conditions like heavy rain, fog, or snow, and in low-light environments. This makes radar indispensable for both safety and autonomy.

In 2024, 169 million radar sensors were shipped globally. On average, passenger vehicles incorporated 0.8 long-range radar units per vehicle, a figure expected to approach 1 unit per vehicle by 2030.

The importance of radar multiplies in robotaxis and shuttles. For example, Cruise vehicles rely on 21 radars per car, while Waymo deploys six high-performance 4D radars. This redundancy ensures robust environmental perception, a necessity for Level 4/5 autonomous fleets.

Meanwhile, regulatory bodies are accelerating adoption. The European Union’s Vehicle General Safety Regulations (effective July 2024) mandate key ADAS features, compelling automakers to deploy radar more broadly.

The Transition: From 3D to 4D Radar

Traditional 3D radars provide range, azimuth, and Doppler information but fall short in resolving elevation data. This makes it difficult to distinguish between complex objects—for instance, differentiating a pedestrian on the sidewalk from a nearby vehicle.

4D imaging radar overcomes these limitations by adding elevation and velocity measurement. By leveraging Massive MIMO (Multiple Input, Multiple Output), Digital Code Modulation (DCM), and AI-based signal processing, 4D radar generates high-resolution point clouds that rival LiDAR in certain applications.

Key adoption milestones include:

- Mercedes-Benz EQS (Drive Pilot) – equipped with advanced 4D radar for conditional automation.

- Hyundai IONIQ 5 – featuring Continental’s ARS540 4D radar, enhancing detection in poor visibility.

By 2025, 4D radar penetration is projected to hit 11.4% of the global automotive radar market, shifting from a niche innovation to a mainstream ADAS and AV technology within just a few years.

Technology Foundations and Frequency Bands

The report highlights the technologies enabling the 4D radar boom:

- Frequency Modulated Continuous Wave (FMCW): The dominant technology for velocity detection and high-resolution imaging. Used in Bosch and Continental radars.

- Massive MIMO: Boosts angular resolution, as in Arbe’s Phoenix radar with 1728 virtual channels.

- Digital Code Modulation (DCM): Improves interference immunity, pioneered by Uhnder’s S80 radar.

- Radar-on-Chip (RoC): Integrates transceivers, DSPs, and MCUs, cutting costs by 20–30%. Key suppliers include NXP (SAF85xx) and TI (AWR2544).

- Synthetic Aperture Radar (SAR): Emerging for ultra-high-resolution niche applications.

Key Frequency Bands

- 77–81 GHz: Dominant for exterior long- and short-range radar (e.g., ACC, AEB, BSD). Compact, high-resolution, and leading in revenue.

- 60 GHz: Gaining traction for in-cabin applications like CPD and occupant monitoring. Used by Vayyar Imaging.

- 24–26 GHz: A legacy band in decline, being phased out due to lower resolution.

- 140 GHz: Currently in R&D, expected to commercialize around 2030–2035 for ultra-high-resolution sensing.

Competitive Landscape and Strategies

The 4D radar market is defined by both established giants and agile startups:

Established Players

Companies like Bosch, Continental, Aptiv, ZF, and Denso dominate through:

- Heavy R&D investment

- Global presence

- Deep OEM partnerships (e.g., Bosch–Volkswagen)

- Focus on sensor fusion (integrating radar, LiDAR, and cameras)

Startups and Emerging Innovators

Startups carve niches with disruptive innovations:

- Uhnder – pioneered RoC with all-digital radar.

- Arbe Robotics – focuses on high-resolution, cost-effective radar for urban AVs.

- Zendar & Waveye – integrating AI for advanced perception.

- RadSee & Sensrad – offering flexible COTS designs and industrial applications.

A collaborative ecosystem is forming, where startups partner with Tier 1 suppliers or OEMs for market entry—e.g., Arbe’s collaboration with BAIC.

Regional Dynamics

Asia-Pacific

- Fastest-growing region with the highest CAGR.

- Driven by China’s EV boom, government-backed smart city projects, and OEM innovation.

- Key examples: SAIC’s partnership with ZF (2022) and NIO’s integration of 4D radar.

- Mass-market EVs and robotaxis in cities like Shanghai present major opportunities.

North America

- Largest revenue share, led by U.S. adoption.

- Automakers including Ford (BlueCruise), GM (Super Cruise), and Tesla (Autopilot) are rolling out radar-based autonomy features.

- Robotaxi leaders Cruise and Waymo heavily rely on 4D radar for fleet deployments.

Europe

- Strong adoption, fueled by stringent EU safety mandates (2024).

- Premium OEMs like Mercedes-Benz and BMW lead with Level 2+/3 systems.

- Radar integration is strongest in luxury and compliance-driven models.

Market Potential: Robotaxis and Shuttles

The greatest long-term opportunity lies in SAE Level 4 and 5 autonomous vehicles. Robotaxis and shuttles require multiple high-performance radars per vehicle—often between 6 and 21 units—to ensure redundancy and safety.

According to the report, the AV segment will record the highest CAGR (127%) from 2025 to 2035, with the 4D radar market for Level 4/5 vehicles projected to hit USD 911 million by 2035.

Key opportunity areas include:

- Urban mobility: Navigating dense city traffic.

- Last-mile delivery: Autonomous delivery fleets using radar for collision avoidance.

- Regulatory support: Mandates for CPD and AEB driving radar adoption.

Key Questions the Report Answers

The study addresses fundamental questions shaping the market, including:

- How fast is 4D radar penetrating across SAE Levels 1–5?

- Which ADAS features rely most on 4D radar?

- How are radar costs evolving with mass production?

- What challenges exist in sensor fusion with LiDAR and cameras?

- How do frequency regulations differ globally?

- Which startups are disrupting the market, and how?

- How are partnerships, M&A, and funding trends influencing growth?

Companies Featured

The report profiles leading OEMs, Tier-1 suppliers, and semiconductor companies, including:

- OEMs: Audi, BMW, Mercedes-Benz, Hyundai, SAIC, NIO, BYD, Toyota, Honda, Ford, GM, Tesla

- Tier-1s: Continental, Bosch, Aptiv, ZF, Denso, Magna, Valeo, Hella, Veoneer, Hyundai Mobis

- Semiconductors & Tech: NXP, Texas Instruments, Infineon, STMicroelectronics, Analog Devices, Xilinx (AMD), NVIDIA, Huawei, Mobileye

- Startups & Innovators: Arbe, Uhnder, Zendar, RadSee, Waveye, Sensrad, Vayyar, Oculii, RFISee, Smart Radar System