ADAS and Autonomous Driving Tier 1 Suppliers in China: Seven Development Trends in the Era of Assisted Driving 2.0

The “ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2025 – Chinese Companies” has recently been added to ResearchAndMarkets.com’s portfolio. This comprehensive study provides an in-depth analysis of domestic Tier 1 suppliers operating in the advanced driver-assistance systems (ADAS) and autonomous driving sector, focusing on the significant evolution and market strategies that have shaped the industry through 2024–2025.

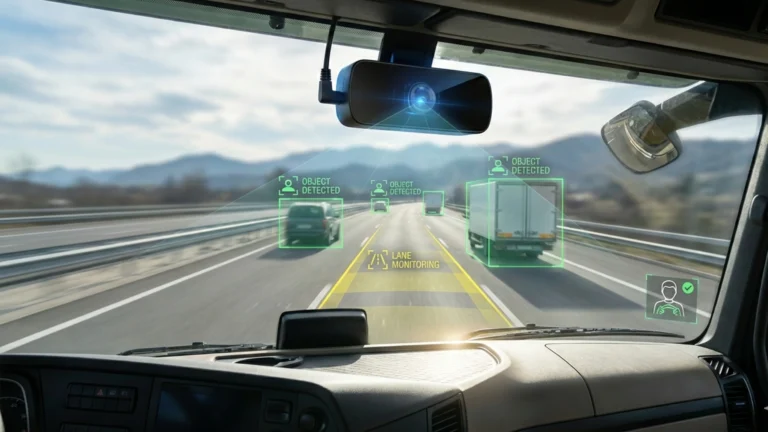

Domestic ADAS Tier 1 Suppliers: Achieving Breakthroughs in the Era of Assisted Driving 2.0

During the L2 era of autonomous driving, international ADAS Tier 1 suppliers dominated the market due to their first-mover advantage and established technology stacks. However, as the market transitioned to L2+ and higher levels (L2+, L2.5, L2.9), domestic suppliers began leveraging three critical capabilities to compete effectively:

- Optimization of mid-range computing chips for automotive-grade AI performance.

- End-to-end algorithm-hardware coordination, ensuring efficient and reliable intelligent driving solutions.

- Rapid adaptation to localized driving scenarios, reflecting unique Chinese urban and highway environments.

These competencies allowed domestic Tier 1 suppliers to gradually gain a dominant position in the market. This evolution is reflected in the increasing coverage of domestic suppliers in the publisher’s reports over the years: in 2022, only seven companies were covered, focusing on basic ADAS functions; by 2023, twelve companies were included, incorporating algorithm-driven emerging players; in 2024, the list grew to twenty, integrating cross-border transformation players; and in 2025, twenty-five companies are analyzed, illustrating the rapid growth and diversification of the domestic ADAS sector.

The report systematically dissects the strategic positioning, technological pathways, and product portfolio strategies of these 25 domestic Tier 1 ADAS suppliers, covering aspects such as global expansion, cross-border technology integration, chip selection, end-to-end intelligent driving iterations, and central computing platforms. Based on this analysis, seven key development trends have emerged.

Trend 1: Rapid Growth of L2.5 and L2.9 as the Leading Market Segment

From 2023 to 2025, the Chinese passenger car market has seen a clear differentiation in intelligent driving adoption. L2.5 and L2.9 systems are growing at an unprecedented pace, becoming the fastest-growing and most installed segments in new vehicles. In 2023, only 4.57% and 3.3% of new models launched featured L2.5 and L2.9 capabilities, respectively. By the first four months of 2025, L2.5-equipped vehicles reached 30.2%, and L2.9-equipped vehicles surged to 34.82%, demonstrating strong market penetration.

Meanwhile, traditional L1–L2 systems are experiencing a decline in installation rates, reflecting increasing consumer demand for higher-level autonomous functions and signaling a structural transformation in the market toward advanced intelligent driving solutions.

Trend 2: Intelligent Driving Enters a “Turning Point” in Popularization

The adoption of high-level ADAS functions is no longer confined to premium vehicles. In 2023, L2.9 systems were primarily offered on mid-range and high-end models priced above RMB 250,000. Models in the RMB 250,000–300,000 range had an L2.9 installation rate of 23.4%, while vehicles priced over RMB 500,000 were at 7.5%. By January–April 2025, these numbers surged to 53.5% and 32.2%, respectively.

As OEMs refine technology roadmaps, L2.9 adoption has expanded to more affordable models: in 2024, vehicles priced RMB 150,000–200,000 included these systems, and by early 2025, even RMB 100,000–150,000 models were equipped. This demonstrates both growing user acceptance of high-level autonomous features and the increasing role of intelligent driving as a differentiating factor for OEMs in the competitive automotive market.

Trend 3: Emergence of Five Major Competitive Camps Among Tier 1 ADAS Suppliers

After several years of market competition, domestic Tier 1 suppliers have consolidated into five distinct competitive camps. Each camp leverages unique technological approaches and resource strengths to establish a differentiated market position. This competitive clustering enables suppliers to focus on specialized areas, such as sensor fusion, centralized computing platforms, end-to-end software solutions, or multi-sensor perception systems, reinforcing innovation while fostering industry specialization.

Trend 4: Accelerated Global Expansion of Domestic Tier 1 Suppliers

In the era of Assisted Driving 2.0, rapid technological iteration and the ability to respond to localized conditions are essential for global competitiveness. Leading domestic Tier 1 suppliers, such as Desay SV, are pursuing overseas expansion strategies combining product adaptation, localized development, and ecosystem integration.

Between 2020 and 2024, Desay SV’s international revenue grew at a compound annual growth rate of 28.9%, reaching RMB 1.708 billion in 2024. Partnerships with global OEMs and collaboration with technology leaders like NVIDIA and Qualcomm have allowed domestic suppliers to provide integrated “chip platform + intelligent solution” offerings, positioning them as key partners for international intelligent mobility upgrades.

Trend 5: Medium-Computing-Power Chips Drive Cost-Performance Balance

Surveying the solutions from 25 domestic Tier 1 ADAS suppliers, it is evident that L2.5 and L2.9 systems predominantly rely on automotive-grade chips with 80–150 TOPS of computing power. Mid-range chips strike an optimal balance between performance and cost, reducing unit computing cost by over 60% compared to high-end chips with 300+ TOPS, while algorithmic optimization ensures coverage of over 90% of driving scenarios.

This approach allows OEMs to deploy high-performance, affordable intelligent driving systems at scale, meeting both market demand and cost constraints.

Trend 6: Shift Toward Algorithm-Hardware Collaborative Optimization

From 2023 onward, the domestic intelligent driving industry has shifted focus from pure computing power competition to algorithm-hardware collaborative optimization, driven by the rise of end-to-end models. Leading chip companies and Tier 1 suppliers have worked closely to scale intelligent driving solutions for mass-market vehicles.

Huawei, for example, advanced from GOD 2.0 + RCR 2.0 in 2023 to the WEWA vehicle-cloud behavior model in 2025, creating a closed-loop decision-making system. SenseAuto developed the UniAD generative intelligent driving solution in 2025, leveraging reinforcement learning to enable vehicles to perform human-like reasoning. QCraft launched a one-model end-to-end solution based on the Horizon J6M chip in April 2025.

Neusoft Reach introduced a dual-model architecture in 2024–2025: the AI Co-Driver for world restoration and AI Planner for decision-making and path planning. By combining heterogeneous sensor fusion with physics-based modeling, Neusoft Reach’s architecture achieves functional safety and regulatory compliance for advanced assisted driving, addressing challenges such as the “black box” nature of AI foundation models.

Trend 7: Expansion into EAI as a Second Growth Engine

Tier 1 ADAS suppliers are increasingly exploring Electronics and AI (EAI) applications to create additional growth avenues. Leveraging sensor technology, computing platforms, and algorithms developed for intelligent driving, these suppliers are moving into pan-robotics and other intelligent systems markets. Strategies include hardware migration, software empowerment, acquisitions, investments, and establishing subsidiaries, effectively extending automotive-grade technologies into adjacent sectors.

Key Insights and Coverage

The report offers a comprehensive examination of the domestic ADAS market, including:

- Chinese ADAS Market Analysis:

- Passenger car ADAS installation volume and rates, 2023–2025

- ADAS solutions for passenger vehicles

- Trends shaping China’s intelligent driving market

- Competitive landscape of Tier 1 suppliers

- Comparison of Tier 1 Products and Solutions:

- Strategic priorities for 2025

- Radar, front-view camera, and LiDAR layouts

- Evolution of front-view cameras and LiDAR technologies

- Intelligent driving solution comparisons

- Profiles of Tier 1 Suppliers:

- Desay SV, Jingwei Hirain, Baidu Apollo, Huawei, Neusoft Reach, Freetech, iMotion, SenseAuto, Yihang.AI, MAXIEYE, Momenta, MINIEYE, PhiGent Robotics, NavInfo, QCraft, Zhuoyu Technology, Horizon Robotics, Joyson Electronics, Huaqin Technology, TZTEK, Lenovo Vehicle Computing, KEBODA, Baolong Automotive, Qianli Technology

- Competition & Cooperation in the Tier 1 Ecosystem:

- Supply chain dynamics in China’s intelligent driving market

- Collaboration models between Tier 1 suppliers and OEMs

- Partnerships with chip vendors

- Software development and cooperation strategies