Commercial Vehicle Urea Tank Market: Growth Drivers, Trends, and Forecast (2025–2034)

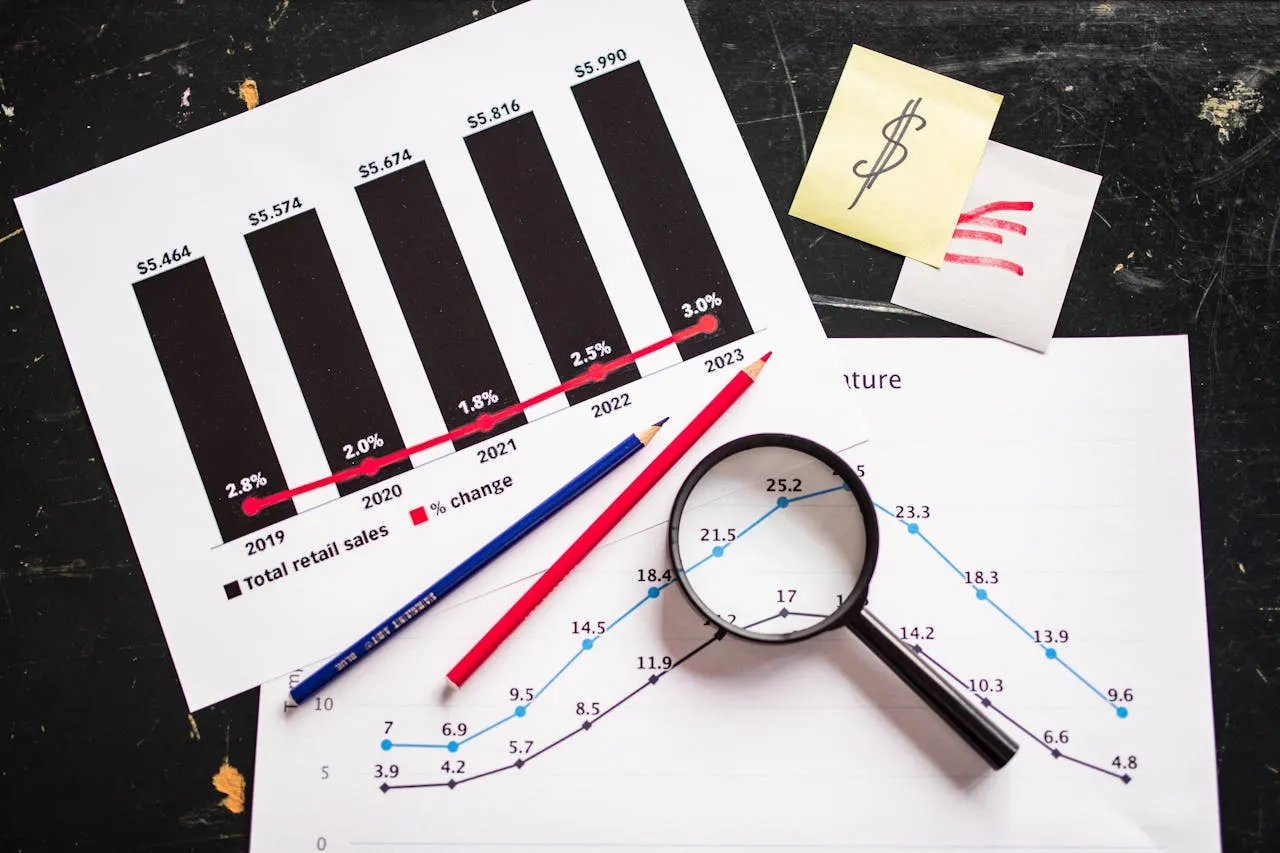

The global commercial vehicle urea tank market reached a value of USD 644.7 million in 2024, with a projected compound annual growth rate (CAGR) of 4.4% from 2025 to 2034. This growth is primarily driven by an increasing focus on environmental regulations

the rising adoption of selective catalytic reduction (SCR) systems, and the growing need to reduce harmful nitrogen oxide (NOx) emissions. With governments worldwide enforcing stricter emission standards, such as Euro VI in the European Union, Bharat Stage VI (BS-VI) in India, and China VI, the demand for urea injection systems in commercial vehicles is surging. These systems are not only vital for reducing NOx emissions but also enhance vehicle performance and fuel efficiency, positioning the urea tank market for sustained growth.

Key Growth Drivers

1. Stringent Emission Regulations

Environmental regulations are at the heart of the market’s expansion. With the increasing emphasis on reducing pollution, regulatory bodies across the globe are tightening emission standards for commercial vehicles. The enforcement of Euro VI standards in Europe, BS-VI in India, and China VI regulations are pushing vehicle manufacturers to incorporate advanced emission control systems, including SCR technology. SCR systems use urea to convert harmful NOx into harmless nitrogen and water vapor, significantly reducing pollution levels.

In particular, the U.S. market is benefiting from regulations such as the EPA’s Greenhouse Gas Phase 2 and the California Air Resources Board (CARB) standards. These regulations have catalyzed the demand for urea tanks in both light and heavy commercial vehicles, as fleet operators strive to meet emission compliance while improving operational efficiency.

2. Adoption of SCR Systems

The adoption of SCR technology is another major driver of market growth. SCR systems are now a standard feature in most commercial vehicles, driven by the demand for cleaner emissions and improved fuel economy. This has resulted in a rise in the demand for urea tanks, as they play a critical role in these systems. As commercial vehicle manufacturers aim to produce more fuel-efficient vehicles that comply with ever-tightening emission norms, the demand for urea tanks is expected to grow steadily.

3. Increasing Fleet Modernization

Another key factor fueling the growth of the urea tank market is the modernization of commercial vehicle fleets. Older vehicles are increasingly being replaced by new models equipped with advanced emission control systems. This trend is driven by both regulatory pressures and the desire for greater operational efficiency. The growing fleet expansion, particularly in the logistics and transportation sectors, further underscores the demand for newer commercial vehicles, which often feature SCR systems and, by extension, urea tanks.

4. Demand for Fuel-Efficient Vehicles

The rising global demand for fuel-efficient vehicles is also a significant driver for the urea tank market. As fuel costs rise and environmental awareness increases, fleet operators are looking for solutions that can reduce operating costs while adhering to emission standards. Urea injection systems, by improving fuel efficiency, are seen as a critical technology in achieving these goals.

Market Segmentation

The commercial vehicle urea tank market is divided into various segments based on capacity, sales channels, material, and application, each with unique dynamics contributing to the overall growth of the market.

1. Capacity Segmentation

The urea tank market is categorized into three segments based on tank capacity:

- Below 50 liters: This segment dominated the market in 2024, with a value of USD 400 million. It primarily caters to light and medium-duty commercial vehicles, such as urban buses and delivery vans, which operate on shorter routes. The smaller tanks are preferred for their lower weight, which enhances fuel efficiency and reduces operational costs.

- 50 to 100 liters: Vehicles requiring medium-sized urea tanks, such as medium-duty trucks, fall into this category.

- Above 100 liters: Larger urea tanks are typically used in heavy-duty commercial vehicles like long-haul trucks, where higher fuel capacity and extended operation times are required.

2. Sales Channel Segmentation

The market is also divided into Original Equipment Manufacturers (OEMs) and the aftermarket. The OEM segment accounted for 60% of the market share in 2024. This dominance is due to the increasing integration of SCR systems in new commercial vehicles, as manufacturers adhere to stricter emission standards. OEMs are a preferred source for urea tanks, as they offer high-quality, compatible components that meet the exact specifications needed for emission compliance.

3. Material Segmentation

Urea tanks are made from various materials, including stainless steel, plastic, and composite materials. The choice of material impacts the durability, weight, and cost of the urea tank. Stainless steel tanks, known for their strength and corrosion resistance, are commonly used in heavy-duty vehicles. Plastic tanks, which are lightweight and cost-effective, are widely used in lighter commercial vehicles.

4. Application Segmentation

The commercial vehicle urea tank market is further segmented based on application into light commercial vehicles (LCV), medium commercial vehicles (MCV), and heavy commercial vehicles (HCV). Each category has different demands in terms of urea tank size and material, aligning with the specific operational requirements of each vehicle type.

Regional Insights

The U.S. commercial vehicle urea tank market, valued at USD 204.4 million in 2024, is projected to grow at a CAGR of 4.7% between 2025 and 2034. This growth is driven by the U.S. government’s push for cleaner transportation technologies and stricter emission regulations enforced by bodies such as the EPA and CARB. As the U.S. continues to enforce these standards, the demand for SCR systems and urea tanks is expected to grow, further fueling the market’s expansion.

In Europe, the market is driven by the Euro VI standards, while in Asia, India and China are contributing significantly to the growth due to their own stringent emission regulations, such as BS-VI and China VI.

Market Challenges

While the commercial vehicle urea tank market shows strong growth potential, there are challenges to consider. The high initial cost of SCR systems and urea tanks is one of the major barriers to adoption. The upfront expense can be a deterrent for smaller fleet operators, particularly in developing regions. Additionally, issues with urea crystallization and freezing in cold weather conditions can affect the performance of SCR systems, which could hinder market growth.

Competitive Landscape

The market is highly competitive, with several key players leading the charge in the development of innovative urea tank solutions. Some of the prominent companies operating in the global market include:

- Amphenol

- Cummins

- Elkamet

- Robert Bosch

- Rochling

- Shaw Development

- Yara International ASA

These companies are focusing on enhancing the efficiency and reliability of urea tanks by adopting advanced technologies and materials.