Ford’s first-quarter 2024 operating results provided more evidence that its segmented, customer-centered strategy is delivering growth and profitability, sharpening capital efficiency and fortifying business durability.

“Customers want vehicles that they’re passionate about, choices in how they’re powered, quality that’s constantly getting better and great value,“ said President and CEO Jim Farley. “With Ford+, we’re increasingly giving them all those things in ways that others don’t and creating a company that will lead for the long haul.”

Nowhere is that momentum more apparent, said Farley, than in Ford Pro, which helps commercial customers improve the productivity of their organizations.

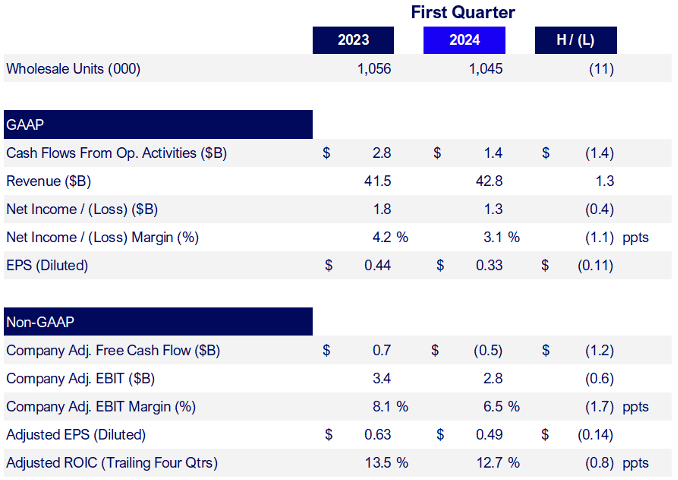

Company Key Metrics Summary

“The Ford Pro team is growing volumes, revenue and profitability – including EBIT margin – and services capabilities,” he said. “We’re seeing real evidence of what’s possible for customers and the company across all our segments, and applying what we’re learning about things like mobile services and value-added software to our retail businesses.”

Relatedly, a new Ford brand campaign is showcasing the company’s distinctive commitment and ability to suit the needs of almost every customer through “Freedom of Choice” across a lineup of high-performing, high-volume gas, hybrid and electric vehicles.

Ford’s revenue for the 2024 first quarter was $42.8 billion, up 3% year-over-year even as vehicle shipments declined slightly. The company has increased revenue in each of the past three years and expects to do so again in full-year 2024. Net income for Q1 was $1.3 billion; adjusted earnings before interest and taxes, or EBIT, totaled $2.8 billion.

Operating cash flow in the period was $1.4 billion; adjusted free cash flow was a use of

$500 million. Both reflected working capital effects from about 60,000 vehicles that were in inventory at the end of the first quarter, but are expected to be shipped in Q2. CFO John Lawler said that the company’s balance sheet remains “rock solid,” with $25 billion in cash and nearly $43 billion in liquidity at quarter-end.

Ford’s continued strong performance and disciplined capital allocation enable the company to fund Ford+ initiatives while also meaningfully returning capital to shareholders – the latter at a targeted rate of 40% to 50% of adjusted free cash flow. Consequently, Ford today declared a second-quarter regular dividend of 15 cents per share, payable June 3 to shareholders of record at the close of business on May 8.

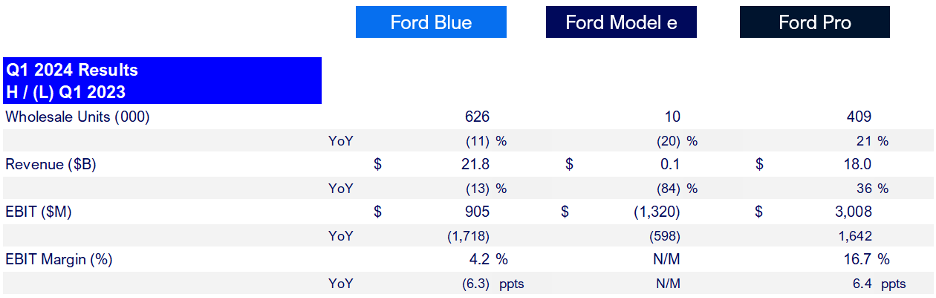

Business Segment Highlights

Ford Pro achieved first-quarter revenue of $18.0 billion, up 36%, together with EBIT of $3.0 billion. The segment’s EBIT margin of nearly 17% exceeded the sustained mid-teens margin target set for the business. The results reflected higher production of Super Duty trucks – the 2024 North American Truck of the Year and the most dependable large heavy-duty pickup after three years of ownership, according to J.D. Power – and Transit vans.

With guidance from Ford Pro, more customers are progressively choosing to electrify their vehicle fleets, including the United States Postal Service (9,250 E-Transit vans through the end of 2024) and Ecolab, the global sustainability company (more than 1,000 F-150 Lightning pickups and Mustang Mach-E SUVs).

Over the past 12 months through the first quarter, about 13% of Ford Pro’s EBIT came from software and physical services, including parts and accessories – on the way to a goal of at least 20% within a few years. Software subscriptions with commercial customers grew 43% year-on-year to more than 560,000 by quarter-end.

Quarterly wholesales, revenue and EBIT for Ford Blue were down in the quarter, all affected by the production ramp and vehicles in inventory of the new 2024 F-150 pickup, which are now being delivered to customers and dealers. Segment revenue was $21.8 billion; EBIT was about $900 million. The business unit was again profitable in every market where it operates around the globe.

Sales of Ford Blue’s hybrid vehicles were up 36%, on pace for projected full-year 2024 hybrid sales growth of 40%. The compact Ford Maverick was America’s No. 1-selling hybrid truck in Q1, and hybrid versions of the new F-150 full-size pickup are now on their way to customers. The business is well along in carrying out a multiyear plan that is further expanding hybrid options around the globe, including hybrid versions of every vehicle in its North America portfolio by the end of the decade.

Ford Model e revenue was down, as wholesales declined and significant industrywide pricing pressure continued to affect electric vehicles currently on the market. The segment had an EBIT loss of $1.3 billion, with costs that were flat year-over-year. The company expects EV costs to improve going forward, but be offset by top-line pressure.

In the meantime, availability of reliable DC fast-charging is more than doubling for Ford EV customers in the U.S. and Canada, as they begin to receive adapters that provide access to more than 15,000 Tesla Superchargers.

Collectively, Ford remains far and away the global truck leader, producing more than 500,000 of them worldwide in the first quarter of the year – gas and, in several cases, hybrid versions of Super Duty, F-150, Ranger and Maverick, along with the all-electric F-150 Lightning.

Ford Credit generated first-quarter earnings before taxes of $326 million, with used-vehicle auction values and lease return rates continuing to normalize.

Full-Year 2024 Outlook

Lawler, the CFO, said that Ford’s full-year adjusted EBIT guidance range is unchanged, with the company tracking to the higher end of the $10 billion to $12 billion range. The company now expects to generate adjusted free cash flow of $6.5 billion to $7.5 billion – up from the initial outlook of $6 billion to $7 billion provided earlier this year.

Additionally, Ford is anticipating capital expenditures for the year of $8 billion to $9 billion – narrower than the $8 billion to $9.5 billion originally estimated and perhaps at the lower end of the range. The update reflects the company’s commitment to capital discipline and efficiency – including recent actions to match investments in support of electric vehicles to revised expectations for the pace of EV adoption by customers.

The company remains on plan to achieve $2 billion in cost reductions in areas like materials, freight and manufacturing.

The segment-level EBIT outlook remains $8 billion to $9 billion for Ford Pro and $7 billion to

$7.5 billion for Ford Blue; an EBIT loss of $5.0 billion to $5.5 billion for Ford Model e; and earnings before taxes of about $1.5 billion for Ford Credit.

Ford’s virtual annual meeting of shareholders is scheduled for Thursday, May 9, at 8:30 a.m. ET. The company plans to report second-quarter 2024 financial results following the close of market on Wednesday, July 24.

Source link:https://media.ford.com/