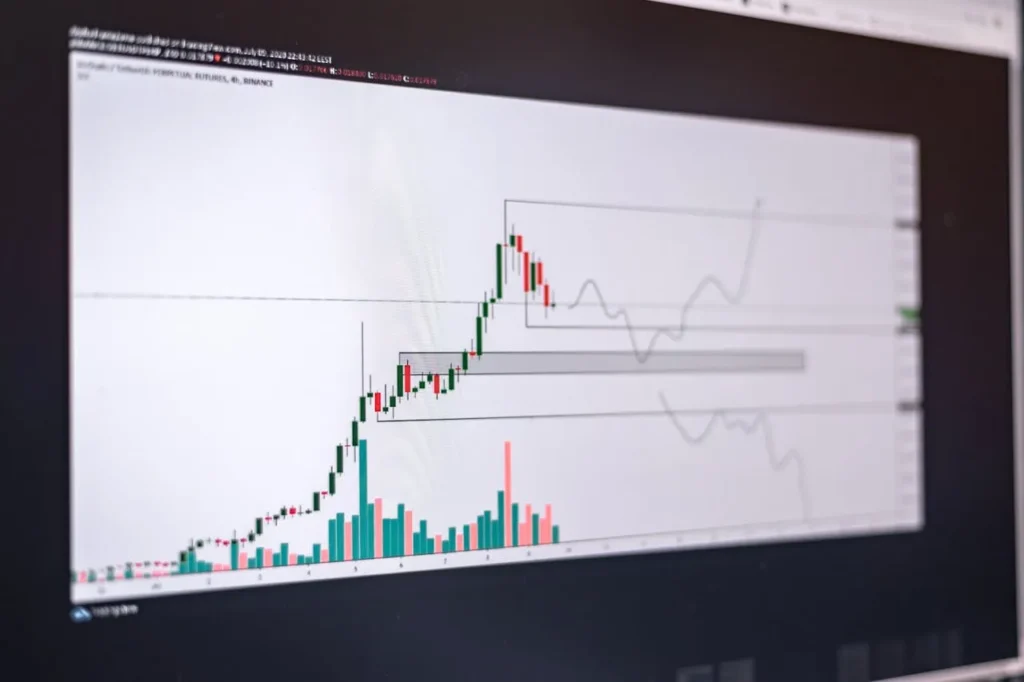

The European Tractor Tires Market is projected to grow steadily, with a forecasted value of USD 762.2 million by 2029, up from USD 624.32 million in 2023, reflecting a compound annual growth rate (CAGR) of 3.38%. This growth is largely driven by various factors, including increased mechanization in agriculture, investments in research and development, and regulatory support promoting sustainability.

Key Growth Drivers

Increased Mechanization in Agriculture

As farming practices become more automated across Europe, the demand for specialized tires designed for modern agricultural machinery continues to rise. Mechanization enhances operational efficiency, but it also necessitates tires that offer better traction, durability, and performance in varying terrains. Tires specifically designed to reduce soil compaction and improve fuel efficiency are in high demand as European farmers increasingly turn to advanced equipment to enhance productivity.

Research and Development (R&D) Investments

Tire manufacturers are dedicating significant resources to research and development to produce higher-performance products tailored for the agricultural sector. Innovations in tire design, such as enhanced tread patterns for improved traction, and the use of advanced materials for longer tire life and lower fuel consumption, are reshaping the market. Manufacturers are also integrating sustainability into their products, such as using eco-friendly materials to meet environmental regulations and reduce the carbon footprint of farming equipment.

Regulatory Support and Sustainability Initiatives

The European Green Deal and other sustainability initiatives are reshaping the agricultural landscape in Europe. With a target of having 25% of agricultural land under organic farming by 2030, these initiatives encourage the adoption of sustainable practices across farming, including the use of equipment and tires that promote soil health and reduce environmental impact. Tires that help minimize soil compaction are increasingly favored, making them a key focus for manufacturers aiming to align with these regulatory frameworks.

Market Trends and Regional Variations

Regional Variations in Tractor Tire Preferences

The European tractor tire market is not uniform; regional differences in farming practices, soil types, and terrain characteristics significantly influence tire preferences.

- Germany: Focused on sustainable farming practices, Germany is witnessing an increasing preference for Very High Flexion (VF) tires, which help reduce soil compaction while providing excellent load-bearing capacity. This trend is driven by a heightened awareness of sustainability among farmers.

- France: With its diverse agricultural sector, France sees a demand for specialized tires that can adapt to different soil types and farming methods. The need for all-terrain tires that provide stability and durability is strong, driven by the country’s varied agricultural practices.

- United Kingdom: In the UK, as farming operations modernize, there is a growing demand for Increased Flexion (IF) tires. These tires offer the flexibility and efficiency needed to handle heavier loads and provide better fuel efficiency, aligning with the trend of farm equipment modernization.

- Italy: Italy’s agricultural specialization further drives the need for custom tire solutions. Different crops and terrain types across the country require tailored tire technology to ensure optimal performance.

Increased Frequency of Tractor Tire Replacement

The demand for tractor tire replacements in Europe is on the rise. This is driven by several factors:

- Agricultural Growth: As food production needs increase to meet the demands of a growing population, farmers are investing in equipment that ensures greater reliability and productivity, which includes more frequent tire replacements.

- Technological Advancements: With constant innovations in tire design, including improvements in durability and performance, farmers are upgrading their tires to capitalize on the latest technologies.

- Environmental Regulations: Stricter environmental standards are prompting farmers to invest in machinery upgrades, which includes replacing tires with those that meet new sustainability and performance criteria.

Technological Advancements in Tire Manufacturing

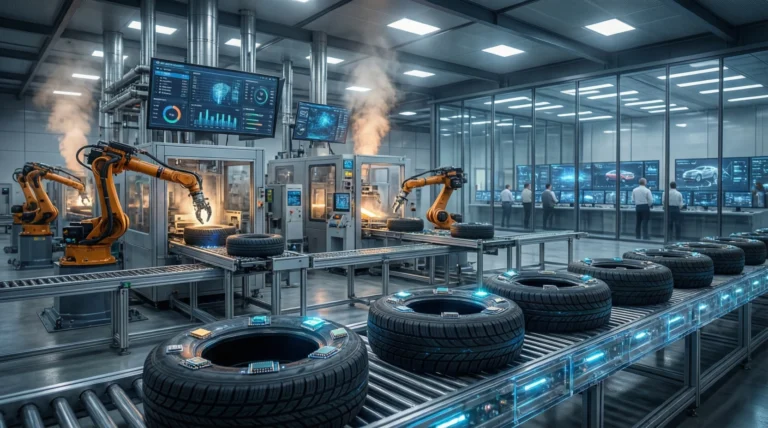

Advances in manufacturing technologies are significantly shaping the European tractor tire industry. Key developments include:

- Industry 4.0 and Automation: The integration of robotics and artificial intelligence in tire production enhances manufacturing efficiency, improving product quality and consistency. This technology allows for faster production cycles and more precise tire designs.

- Additive Manufacturing (3D Printing): The use of 3D printing technology allows manufacturers to prototype new tire designs quickly, which accelerates innovation. Michelin, for example, has utilized 3D printing to create more eco-friendly tire designs.

- Sustainable Materials: The shift towards sustainable materials is evident in products like Bridgestone’s Guayule rubber, which is an environmentally friendly alternative to traditional rubber. This move is part of the broader push for sustainability in the European agricultural sector.

- IoT Integration: The Internet of Things (IoT) allows for real-time monitoring of tire conditions, enhancing maintenance and performance tracking. Sensors embedded in tires enable farmers to track tire pressure, wear, and other parameters, optimizing their machinery’s performance and extending tire life.

Regional Market Dynamics

France and Germany: Market Leaders

France and Germany play a pivotal role in the European tractor tire market, together accounting for nearly 30% of all agricultural tractors registered in Europe in 2023. These countries are not only major consumers but also key manufacturers of agricultural machinery, creating a strong demand for high-quality tractor tires.

- Germany: The mechanization of agriculture and the focus on sustainable farming practices make Germany a key player in the tractor tire market. Companies like Continental are expanding their agricultural tire portfolios in response to this growing demand.

- France: The French market is buoyed by the increasing mechanization of agriculture, coupled with a focus on improving agricultural efficiency. The demand for specialty tires in France continues to rise as the agricultural sector modernizes.

Vendor Landscape

The European tractor tire market is moderately consolidated, with several prominent manufacturers holding substantial market shares. These companies are responding to the evolving market dynamics through product innovation, strategic partnerships, and regional expansions. Key players in the market include:

- Bridgestone Corporation: Known for its innovative tire solutions, Bridgestone offers a wide range of agricultural tires focused on durability and performance.

- Continental AG: A major player in the agricultural tire sector, Continental is expanding its portfolio to meet the growing demand for efficient and sustainable farming tires.

- Michelin: A well-known name in the tire industry, Michelin provides high-performance tires tailored to the diverse needs of the agricultural market.

- Titan International: Titan offers a broad range of tires for agricultural machinery, with products designed for various types of tractors and farming equipment.

- Yokohama Rubber Co., Ltd.: Known for its high-quality products, Yokohama is committed to sustainable tire manufacturing practices.

Other notable players include Trelleborg, Nokian Tyres, and Balkrishna Industries, all of which are actively contributing to market growth through technological advancements and strategic collaborations.

The European tractor tire market is set to experience steady growth through 2029, driven by mechanization in agriculture, technological advancements in tire manufacturing, and a growing focus on sustainability. The demand for specialized, high-performance tires is rising, with regional preferences shaping product offerings. Leading tire manufacturers are leveraging innovation and forming strategic partnerships to capture a larger share of this expanding market. With a focus on performance, durability, and environmental sustainability, the tractor tire industry in Europe is poised for continued growth, offering opportunities for both established companies and new entrants.