The Germany Electric Vehicle and Charging Infrastructure Market Databook – 75+ KPIs Covering EV Market Size by Value and Volume, Vehicle Type, Price Point, Propulsion Type, Component, Location – Q2 2024 Update” report, available through ResearchAndMarkets.com, provides a comprehensive analysis of the country’s electric vehicle (EV) market. It offers insights into the market’s growth, challenges, and future outlook, with over 75 key performance indicators (KPIs) to help stakeholders understand various market dynamics, including market size, volume, vehicle type, and charging infrastructure.

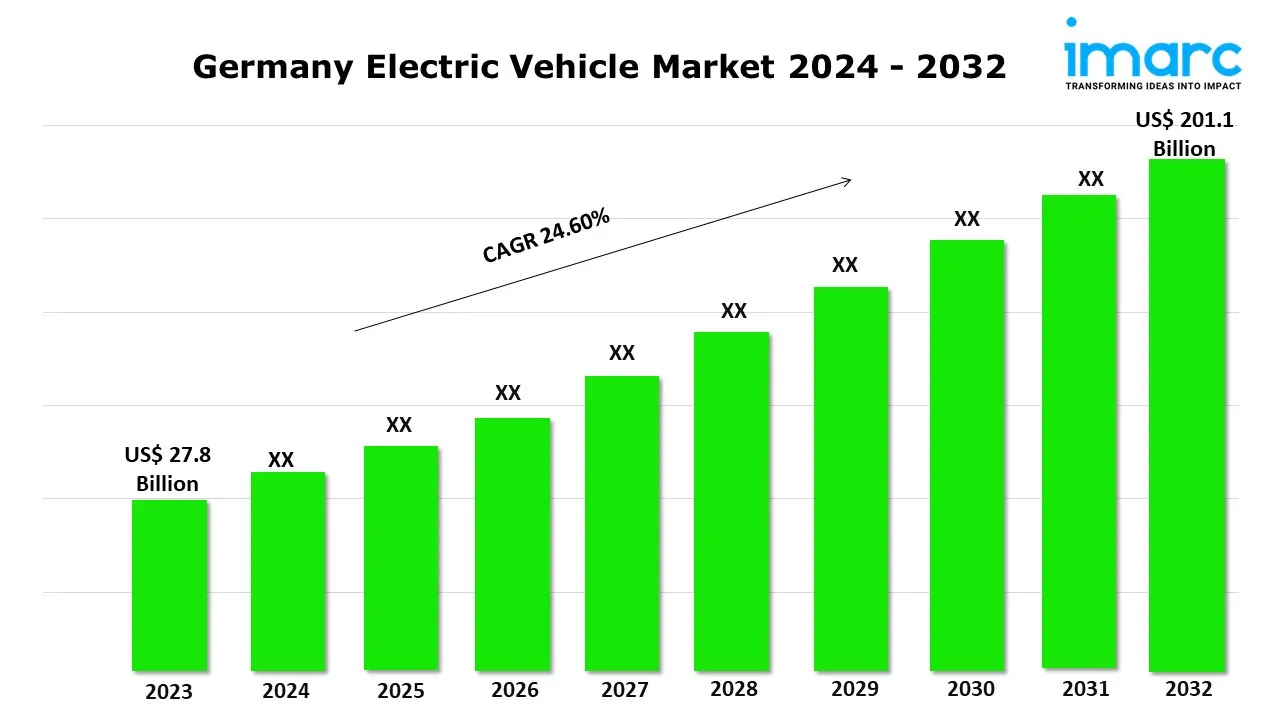

In 2024, Germany’s electric vehicle market is projected to grow by an impressive 28.9% on an annual basis, reaching a value of $44.6 billion. Despite this short-term growth, the medium to long-term outlook remains strong. The market is expected to experience a compound annual growth rate (CAGR) of 24.2% from 2024 to 2028, with the total value of the electric vehicle market in Germany projected to rise from $34.6 billion in 2023 to $106.1 billion by 2028. This indicates a robust long-term adoption trajectory for electric vehicles in Germany.

However, the market is facing a challenge in the short term, as the government has ended its subsidy program, which provided financial incentives to consumers for electric vehicle purchases. The abrupt termination of the consumer support scheme in December 2023, alongside the expiration of corporate subsidies for fully electric vehicles in September 2023, has led to a decline in EV sales. This slowdown is expected to continue in the immediate future, potentially hindering the growth of the electric vehicle industry in Germany over the next few years.

Despite these challenges, the electric vehicle industry continues to witness innovation, with numerous EV-focused startups raising venture capital. A notable example is Enapi, a platform designed to enhance collaboration within the EV charging industry. In March 2024, Enapi secured €2.5 million in pre-seed funding, led by Project A Ventures and supported by Seedcamp and HelloWorld. With this funding, Enapi aims to expand its network, improve data quality on its platform, and develop clearinghouse functionalities to scale charge point connectivity. Enapi’s platform helps connect Charge Point Operators (CPOs) with developers and digital charging solution providers. The platform aims to address issues related to technical interoperability and improve data transparency for electric vehicle users.

Moreover, German automotive giants like Mercedes-Benz are investing heavily in the expansion of charging infrastructure in global markets. In November 2023, Mercedes-Benz announced a substantial investment to expand its charging network in South Africa. The company is set to invest R40 million to install 127 charging stations in the region, with the first phase of the project aiming to establish 67 Mercedes-Benz EQ-branded charging stations by Q1 2024. The second phase will see the installation of an additional 60 stations. This investment is part of Mercedes-Benz’s broader strategy to support full electrification and sustainability, particularly in developing markets such as South Africa.

Additionally, Mercedes-Benz has also focused on expanding its electric vehicle charging network in India. By enhancing the charging infrastructure in these regions, the company aims to accelerate the global transition to clean energy vehicles.

The report provides an in-depth data-driven analysis of the German electric vehicle and charging infrastructure market, detailing key segments and categories, such as vehicle types, components, charging types, and locations. It also breaks down market opportunities for various vehicle segments, including passenger cars, commercial vehicles, and electric buses.

For example, the German electric vehicle market is categorized into various vehicle segments, including small, medium, and large cars, as well as electric buses. The market is also segmented by vehicle class, which includes low-priced, mid-priced, and luxury-class vehicles. Another important segment is the propulsion type, which covers plug-in hybrid electric vehicles (PHEVs), battery electric vehicles (BEVs), hybrid electric vehicles (HEVs), and fuel cell electric vehicles (FCEVs). The report also delves into the market by distance range, with categories such as vehicles with a range of up to 150 miles, between 151-300 miles, and above 300 miles.

In terms of charging infrastructure, the report outlines the number of charging points and stations, segmented by charging type and speed. For example, it covers normal charging, supercharging, slow, fast, rapid, and ultrarapid charging. Additionally, the report provides insights into the geographic distribution of charging points, with specific data on locations such as residential areas, workplaces, and public streets.

The electric vehicle infrastructure segment also includes information on different charging connection types, including CSS, CHAdeMO, GB/T, and others. Furthermore, the report highlights the number of charging points by vehicle type, with categories for passenger cars, buses, trucks, and light commercial vehicles.

In conclusion, the electric vehicle market in Germany presents a dynamic landscape, characterized by significant growth potential, despite short-term challenges such as the end of government subsidies. With continued innovation in charging infrastructure and the expansion of EV networks, the German market is poised to remain a leader in the global electric vehicle transition. The report provides stakeholders with the necessary tools to navigate this evolving market, offering detailed insights and forecasts that will help shape business decisions in the coming years.