The “Automotive Logistics Market by Type, Activity, Mode of Transport, Logistics Solution, Distribution, and Region 2023-2028” report has been added to ResearchAndMarkets.com’s offering.

The global automotive logistics market size reached US$ 266.9 Billion in 2022. Looking forward, the market to reach US$ 382.7 Billion by 2028, exhibiting a growth rate (CAGR) of 6.23% during 2023-2028.

The rising automotive production and sales, shifting consumer inclination toward electric vehicles (EVs), and the augmenting need for spare auto parts for the existing vehicle fleet represent some of the key factors driving the market.

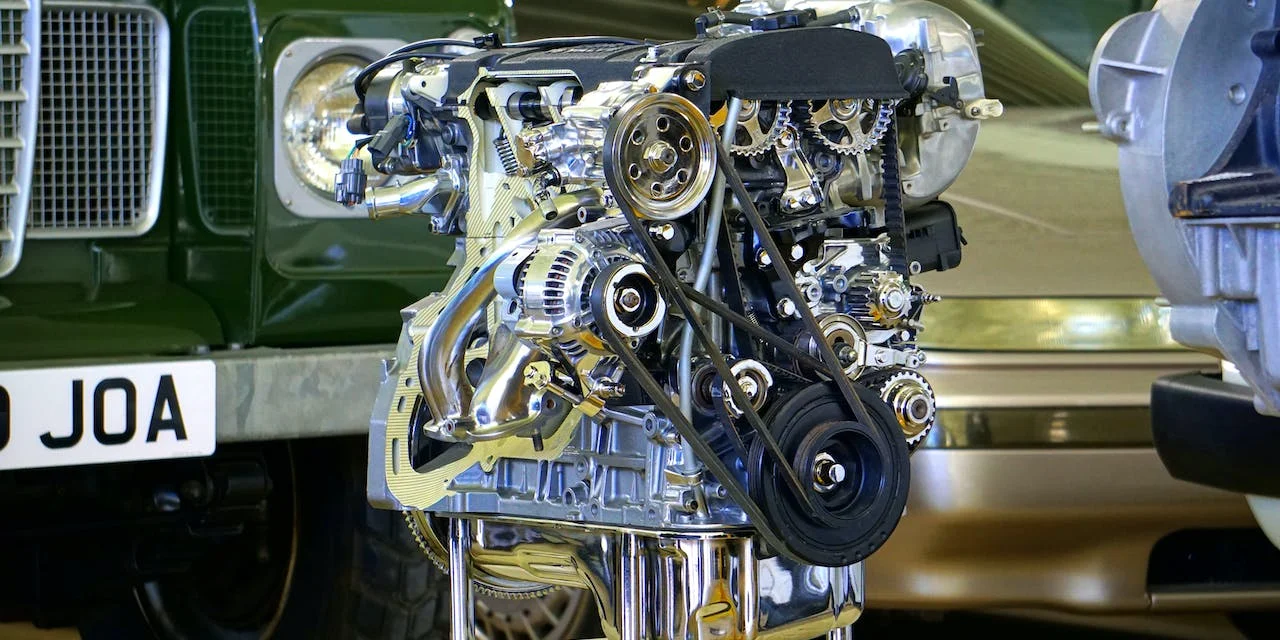

Automotive logistics involves coordinating, warehousing, and moving finished vehicles and related auto components and replacement parts from supplier to consumer. It provides seamless transportation, storage, unloading, loading, distribution, and data processing of resources, including spare automobile parts, production material, equipment, inventory, and whole cars, to the desired destination.

The process comprises the management of the flow of goods from the point of origin to the point of consumption to ensure a smooth flow of operations and meet customer requirements. It aids in lowering costs, generating revenue in the supply chain, and facilitating the effective management of logistical operations while ensuring the availability of raw materials. As a result, automotive logistics forms a crucial part of supply chain management across the automobile sector.

Asia-Pacific was the largest market for automotive logistics. Some of the factors driving the Asia-Pacific automotive logistics market included its expanding automotive sector, inflating sales of EVs and autonomous vehicles, favorable government policies, improving transportation infrastructure, etc.

Automotive Logistics Market Trends:

In recent years, a significant rise in automobile production and sales across the globe due to the expanding urban population, inflating consumer purchasing power, and elevating living standards represents the primary factor driving the market growth. Moreover, the rapid growth in international trade owing to an upsurge in e-commerce activities and an increase in the free trade agreements between various countries is supporting the market growth.

Besides this, the growing need for spare auto parts for the massive existing automobile fleet in the aftermarket has augmented the demand for automotive logistics. Additionally, there has been a substantial increase in the sales of lightweight, fuel-efficient cars and electric vehicles (EVs) due to stringent emission regulations and favorable tax incentives and subsidies offered by governments to encourage the uptake of EVs.

The implementation of such initiatives regarding carbon emissions is also generating the need for upgraded standard aftermarket parts for the existing vehicle fleet. This, coupled with the escalating logistics activities owing to high consumer demand and huge trucking networks, has catalyzed market growth.

Furthermore, the leading service providers are utilizing innovative technologies, such as artificial intelligence (AI), the Internet of Things (IoT), Big Data, and connected ship, to improve their supply chain management processes and ensure the timely delivery of goods to customers. These technologies assist in reducing labor costs by leveraging predictive analytics on routing, thereby eliminating delays in shipments, which in turn is propelling market growth.

Other factors, including the augmenting demand for systematic storage and effortless material handling, increasing adoption of just-in-time (JIT) and world-class quality strategies by key players, improving transportation networks, and the advent of autonomous trucks, are also creating a positive market outlook.

Key Market Segmentation:

The report has provided a detailed breakup and analysis of the automotive logistics market based on the type. This includes finished vehicles and automotive parts. According to the report, automotive parts represented the largest segment.

A detailed breakup and analysis of the automotive logistics market based on the activity has also been provided in the report. This includes warehousing and handling and transportation and handling. According to the report, transportation and handling accounted for the largest market share.

The report has provided a detailed breakup and analysis of the automotive logistics market based on the mode of transport. This includes roadways, airways, maritime, and railway. According to the report, railway represented the largest segment.

A detailed breakup and analysis of the automotive logistics market based on the logistics solution has also been provided in the report. This includes inbound logistics, outbound logistics, reverse logistics, and aftermarket logistics.

The report has provided a detailed breakup and analysis of the automotive logistics market based on the distribution. This includes domestic and international. According to the report, domestic represented the largest segment.

Key Questions Answered in This Report:

- How has the global automotive logistics market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global automotive logistics market?

- What is the impact of each driver, restraint, and opportunity on the global automotive logistics market?

- What are the key regional markets?

- Which countries represent the most attractive automotive logistics market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the automotive logistics market?

- What is the breakup of the market based on the activity?

- Which is the most attractive activity in the automotive logistics market?

- What is the breakup of the market based on the mode of transport?

- Which is the most attractive mode of transport in the automotive logistics market?

- What is the breakup of the market based on the logistics solution?

- Which is the most attractive logistics solution in the automotive logistics market?

- What is the breakup of the market based on the distribution?

- Which is the most attractive distribution in the automotive logistics market?

- What is the competitive structure of the global automotive logistics market?

- Who are the key players/companies in the global automotive logistics market?

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 141 |

| Forecast Period | 2022 – 2028 |

| Estimated Market Value (USD) in 2022 | $266.9 Billion |

| Forecasted Market Value (USD) by 2028 | $382.7 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

Competitive Landscape:

- BLG Logistics Group AG & Co. KG

- Bollore Logistics (Bollore SE)

- C.H. Robinson Worldwide Inc.

- CEVA Logistics (CMA CGM)

- CFR Rinkens LLC

- Dachser Group SE & Co. KG

- Deutsche Post DHL Group

- DSV A/S

- Hellmann Worldwide Logistics SE & Co. KG

- Kerry Logistics Network Ltd. (SF Express Co. Ltd.)

- Kuehne + Nagel International AG

- Neovia Logistics Services LLC

- Nippon Express Co. Ltd.

- Penske Logistics Inc. (Penske Truck Leasing Co. L.P.)

- Ryder System Inc.