Li-Cycle Announces Controversial Underwritten Public Offering to Fuel Growth in Lithium-Ion Battery Recycling

Li-Cycle Holdings Corp., a leader in lithium-ion battery resource recovery, has sparked debate with its announcement of a proposed underwritten public offering (“the Offering”) in the United States. This bold move aims to fund the company’s ambitious plans for expansion while driving its mission to support a cleaner energy future.

Key Details of the Offering

The Offering will involve the sale of units consisting of two primary components:

- Common Shares or Pre-Funded Warrants: Investors may choose between purchasing common shares or pre-funded warrants in place of these shares.

- Warrants for Additional Shares: These warrants will provide holders with the right to purchase additional common shares in the future.

To manage potential over-allotments, Li-Cycle has granted Aegis Capital Corp. a 45-day option to purchase up to an additional 15% of both common shares and warrants issued in the Offering. This ensures flexibility to address higher-than-expected demand.

Purpose of the Offering

Proceeds from the Offering are earmarked for:

- Working Capital: Supporting day-to-day operations as Li-Cycle scales its business.

- Corporate Growth Initiatives: Driving innovation and expansion in lithium-ion battery recycling to meet the rising demand for sustainable energy solutions.

Market Listing and Financial Considerations

Li-Cycle’s common shares are traded on the New York Stock Exchange (NYSE) under the ticker symbol “LICY”. However, warrants and pre-funded warrants offered in this deal will not be listed on any exchange. The completion of the Offering remains subject to prevailing market conditions and other regulatory requirements, with no guarantees regarding its final size or terms.

Collaborations and Legal Oversight

- Aegis Capital Corp.: Acting as the sole book-running manager on a firm commitment basis.

- Legal Counsel: Freshfields US LLP represents Li-Cycle, while Sichenzia Ross Ference Carmel LLP advises Aegis Capital Corp.

It is important to clarify that this press release does not constitute an offer to sell or a solicitation for the purchase of any securities. Additionally, no sales of these securities will be made in any state or jurisdiction where such an offer, solicitation, or sale would be illegal without proper registration or qualification under the securities laws of the relevant jurisdiction.

About Li-Cycle Holdings Corp.

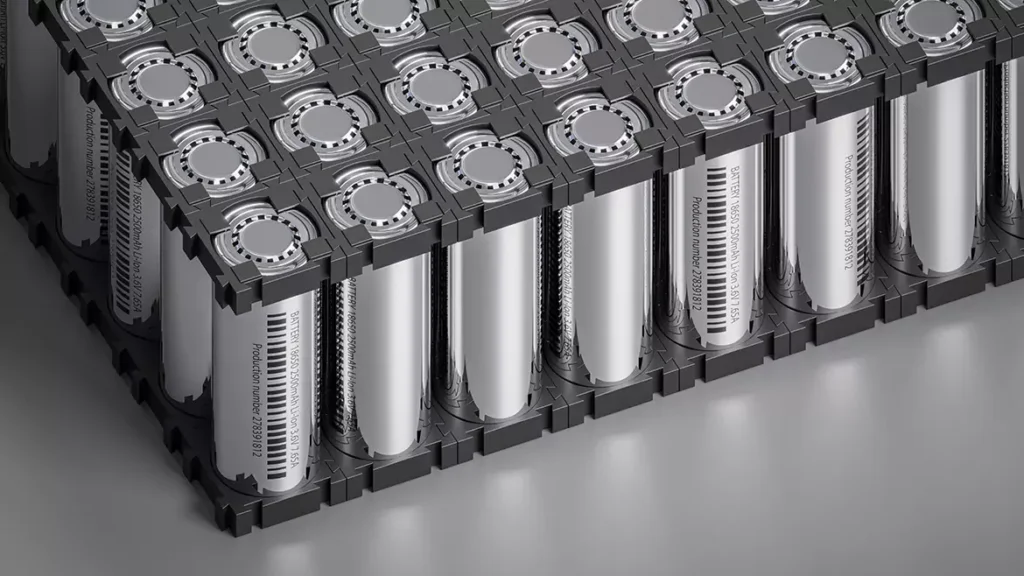

Li-Cycle (NYSE: LICY) is a prominent global leader in lithium-ion battery resource recovery. Founded in 2016, Li-Cycle has built a robust network of key customers and strategic partners around the world. The Company’s mission is to recover critical, battery-grade materials, ultimately aiming to establish a sustainable, closed-loop battery supply chain that will support a clean energy future.

Li-Cycle utilizes its innovative, sustainable, and patent-protected Spoke & Hub Technologies™ to recycle various types of lithium-ion batteries. At their Spokes (pre-processing facilities), the Company recycles battery manufacturing scrap and end-of-life batteries to produce black mass, a powder-like substance that contains valuable metals such as lithium, nickel, and cobalt. Li-Cycle’s future Hubs (post-processing facilities) will be responsible for processing the black mass into critical battery-grade materials, including lithium carbonate, which is essential for the lithium-ion battery supply chain. For more detailed information, you can visit the Company’s website at https://li-cycle.com/.

Forward-Looking Statements

This press release contains forward-looking statements, which are based on assumptions and expectations about future events that are inherently uncertain. These statements may include the use of words such as “believe,” “may,” “will,” “continue,” “expect,” “should,” “plan,” “potential,” “future,” or other similar expressions that indicate future outcomes.

The forward-looking statements in this release include, but are not limited to, expectations regarding the completion and terms of the Offering and how the net proceeds from the Offering will be utilized by the Company. These statements are based on various assumptions about Li-Cycle’s operations, including the successful execution of its business strategy and its ability to secure financing, maintain customer relationships, and expand its recycling capacity.

However, there are risks and uncertainties that could cause actual outcomes to differ materially from those anticipated. These include the ability of the Company to access funds under its loan facility with the U.S. Department of Energy (DOE Loan Facility), the ability to meet the conditions for further project funding, and the ability to complete and meet the productivity targets of its Spoke optimization and expansion plans. Additionally, challenges may arise in securing feedstock, obtaining financing on favorable terms, and executing strategic plans for the Company’s Rochester Hub and other projects.

Li-Cycle also faces potential risks related to its ability to continue as a going concern, insurance limitations, dependence on a limited number of commercial partners, and risks of legal or regulatory proceedings that may adversely affect its financial performance.

These forward-looking statements are not guarantees and are subject to change. Li-Cycle assumes no obligation to update or revise the statements except as required by law. As always, potential investors are encouraged to carefully consider these risks and uncertainties before making any investment decisions.

For further details regarding risks and uncertainties, readers should refer to the Company’s filings with the U.S. Securities and Exchange Commission, including its most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, which provide comprehensive insight into the key factors affecting Li-Cycle’s performance.

In summary, this offering is part of Li-Cycle’s ongoing commitment to securing the necessary capital to drive the growth of its innovative business model. The Company continues to seek ways to transform the lithium-ion battery recycling industry and further its goal of a sustainable and clean energy future.